According to data from CoinGlass, the largest liquidation event in crypto history occurred on Friday, with more than $19 billion of positions liquidated in just 24 hours. In the days since, industry experts have conducted a post-mortem on the chaos, and rising leverage has been highlighted as a potential risk to the long-term health of crypto markets.

Also Read: Crypto Market Sees Historic $19 Billion Liquidation After Trump Tariffs

The rise in popularity of Hyperliquid, a decentralized exchange that specializes in perpetual futures, has made leverage in crypto more accessible than ever, leading to rival exchanges competing over their leveraged offerings. Some experts believe this creates systemic risk, and asset management firm Bitwise is even considering changing strategy as a result.

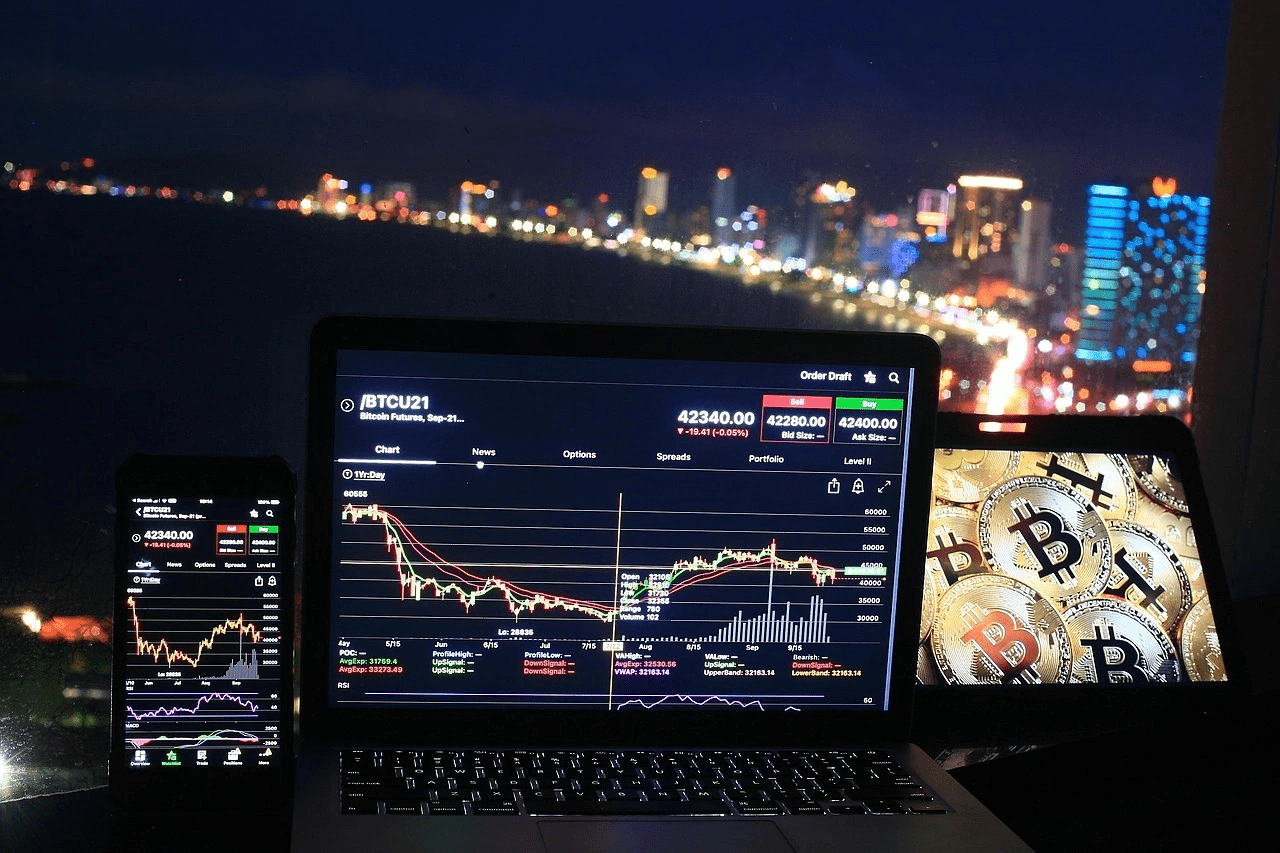

Leverage allows traders to make bets using borrowed funds, which creates the risk of forced liquidation if problems arise. Often, leverage is combined with perpetual futures, which allow traders to speculate in the direction of an asset—called “long” or “short”—with derivative contracts that never expire.

These trading strategies create a combination of very high risks that are amplified and exposed by big moves like Friday’s. In traditional markets, restrictions and assessments apply to users attempting to access the highest levels of leverage. Similar systems exist on centralized exchanges, for example, Binance requires users to pass risk tests to trade at any leverage. However, decentralized exchange Hyperliquid has grown rapidly this year, offering leverage of up to 40x and requiring no disclosures or customer tests – and that’s part of the selling point.

Arian Shikhalian, head of research at venture capital firm CMT Digital, told Decrypt: “What we’re seeing, especially in the perps markets, is that leverage is the point of competition with these exchanges. Marginal competition creates systematic risk in that sense.” “They compete by lowering collateral ratios or margining potentially related assets, or raising liquidation thresholds too late as a result of this underlying competition.”

This competition can even be seen with the recent emergence of the competing decentralized exchange Aster, which offers an impressive leverage of up to 1001x in Bitcoin.

As a result, James Butterfill, head of research at CoinShares, told Decrypt that trading volumes for derivatives, which allow for the use of leverage, have more than doubled in the past year. According to him, compared to cash transactions, derivatives account for 73.7% of the volume of centralized transactions.

Source: IndexBox Market Intelligence Platform