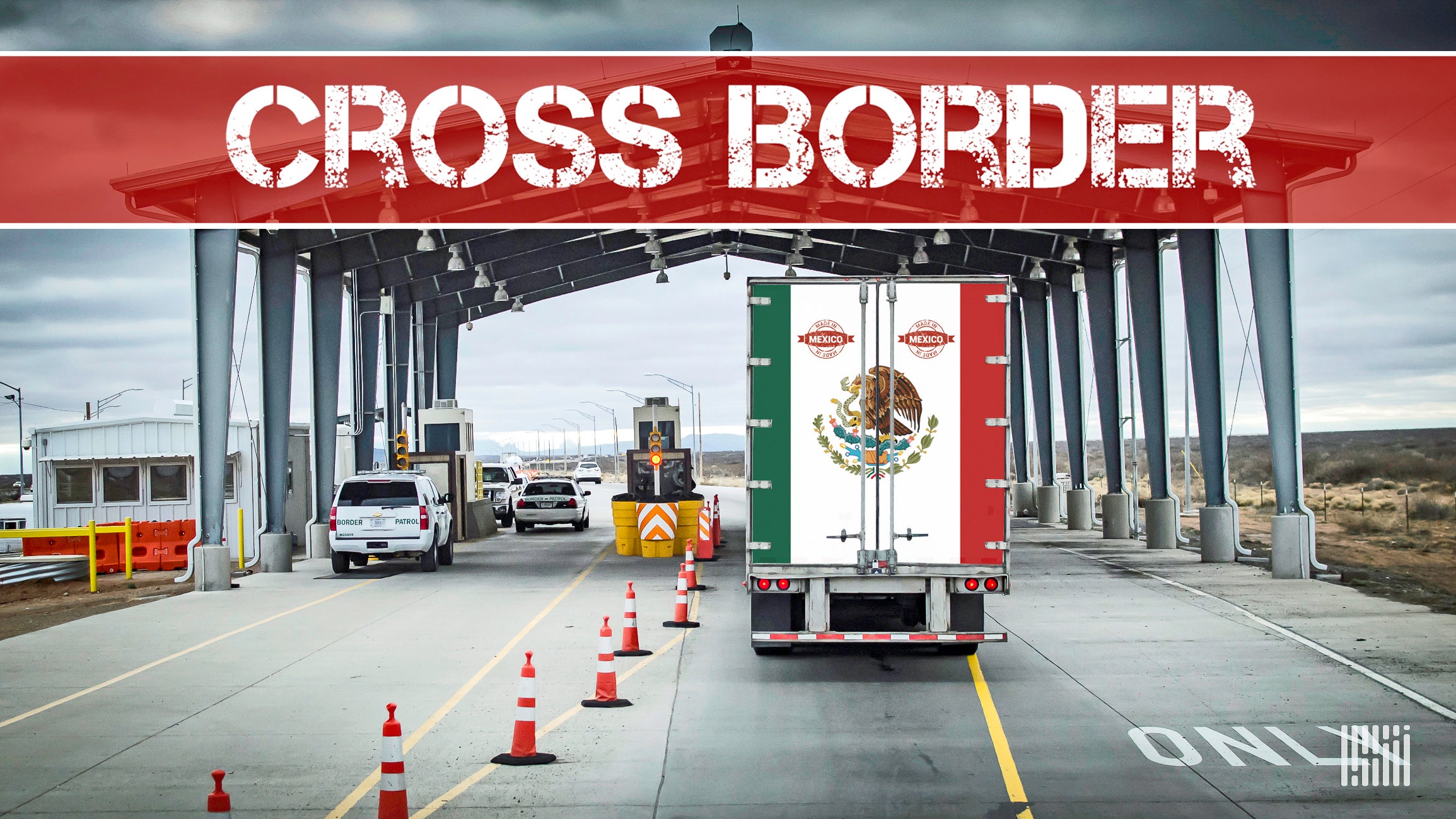

The Borderlands Mexico is a week of developments in the world of US -Mexico border transportation and trade. This week: A. Duie Pyle is limited to the border LTL market. The parentheses of the Mexican heavy truck industry open to the new Dallas-Fort Worth Breight Hub.

A. Duie Pyle, one of the oldest family carriers in the country, is expanding its LTL Operations Out of the northeast with a border service that connects Mexico and the United States

According to Frank Graniri, CEO of A. Duie Pyle, CEO of A. Duie Pyle, this expansion is a direct response to customer demand and the rapid transformation of North American supply chains.

“Our loyal customers rely on A. Duie Pyle to adapt to their evolving needs,” Graniiri told Freightwaves. “Border solutions appeared as a growing priority in our three -month business reviews. Given recent industry developments and increased customer demand, we recognized this as an ideal time to meet these needs with a solution that uses Pyle’s main strengths in reliable and efficient preparations.”

With the arrival of the US -Mexico market, PYLE intends to provide reliability of service, integration of technology and customer vision into one of North America’s rapid commercial corridors, Graniri said.

To the leaders of the future formation of the burden on

F3: Future of Transport Festival, October 21-22Human

Network with the best industry and discovery of later itemsHuman

The end view to the end from the border to the northeast

A. Duie Pyle is a private cargo and logistics company based in West Chester, Pennsylvania. Founded in 1924 and became one of the largest regional carriers in the northeast.

The main trade of the company is LTL Breight, which has a dense service footprint across the northeast, the Middle Atlantic and parts of the southeast. The telecommunications company operates more than 30 service centers and provides coverage of the next and two -day days in some of the busiest transport corridors in the country.

The new border services of A. Duie Pyle connect the cross -off operations at the main border gates such as LARDO and El Paso, Texas, with the aim of providing flexible and flexible billing options.

Transportation can choose between divided or integrated factors and give them control of operational and financial processes, Graniri said.

“This strategy enables us to integrate our technology technology platforms with the US cross -end operators from the border, resulting in faster shipping time and lower demand ratio compared to traditional national LTL carriers,” he said. “This model uses close partnerships with cross -operators and loaded truck carriers that provide continuous reliability in the northeast, where it is processing and delivery of cell assets.”

The demand for direct and reliable access from the border in recent months, especially among car customers, production and consumer goods shipped from northeast and northeast, has increased sharply, Graniri said.

“This demand creates new opportunities to improve our services,” he said. “Our customers want to maintain their supply chain view effectively from the complexities of border logistics.”

The story of two LTL markets

The low market of the United States is expected to be a $ 114 billion trade in 2025 in 2025. Some of the largest LTL providers in the United States include FedEx Freight, Old Dominion, XPO, Estees, Saia, ABF, Averitt and A. Duie Pyle.

In contrast, the LTL section of Mexico is smaller and more fragmented, built around partnerships and integrations instead of dense terminal networks. Main internal providers include Estafeta, PaqueTexpress, Castores and Tresguerras.

While the strict statistics are scarce, the Mexican overall transport and logistics market is about $ 124 billion in 2025 and LTL is one of its fastest growth-to expand approximately 6 % through 2029 as e-commerce and close driving demand for smaller, frequent, frequent.

Participation and control of the process

Instead of creating its own network in Mexico, A. Duie Pyle uses collaboration with Mexican carrier and customs brokers, while cooperating with regulatory and stained operations on both sides.

“We work with experienced customs brokers to ensure that all cargoes meet the necessary conditions,” Graniri said. “In collaboration with reliable Drayage providers on both parties, we can continue transporting quickly and maintain reliability for our customers.”

Granieri also observes a long-term movement in the Mexican production sector, resulting from proximity to business and trade stability caused by the US-Mexico-Canada agreement.

“As the developing work continues, manufacturers and suppliers will look for simpler transport solutions to meet the need for increased and timely delivery,” Graniri said. “Pel -Border Services, focusing on finishing and reducing the transit time, push us to invest in this demand and expand its footprint in the border LTL space.”

Brackets of the Mexican heavy truck industry to slow down speed

Industry stakeholders said the Mexican heavy truck production sector has faced one of its most severe recessions in recent years, as production, exports and sales are still reduced among economic sources and tariff uncertainty.

The National Bus, Truck and Tractor Association (ANPACT) and the Mexican Association of Automotive Dealers (AMDA) reported that the production of freight trucks declined by 59.3 % in September compared to 6,857 units-the least monthly figure since 2018.

Exports of heavy trucks have fallen by 58.3 % compared to last year to 5196 units in September, while domestic sales fell by 34.5 % to 3,358 units.

AnPact will now close the project with about 40,200 units sold in 2025, from the previous forecast of 43,600 in June and much below 50,000 forecast at the beginning of the year.

At a news conference on Thursday, President Anpact Rogelio Arzate described the situation as “very complicated” and cited the US demand reduced, along with imports of used trucks that continue to pressure domestic sales.

Arazate also said there is also uncertainty about US 25 % tariff on heavy Mexican trucks.

Maersk will open the new Dallas-Fort Worth Breight Center

The Maersk World Transport Giant has opened a 100,000-square-foot integrated station and Hub Hub in Copol, Texas, just five miles with Dallas-Fort International Airport.

These facilities expand US logistics footprints before the seasons of the peak holiday and replace the company’s adjacent station in Irving.

The Coppell hub is designed to process thousands of weekly cargoes on both local and national networks. The pickup operation combines a long delivery and long distance under one roof to increase the speed and efficiency of the business to the consumer to trade and trade, Morsak said.

With seven stations in Texas and more than 65 facilities in North America, Maress said the Coppell hub supports increasing demand for less loading services, full trucks and the last miles to improve reliability.