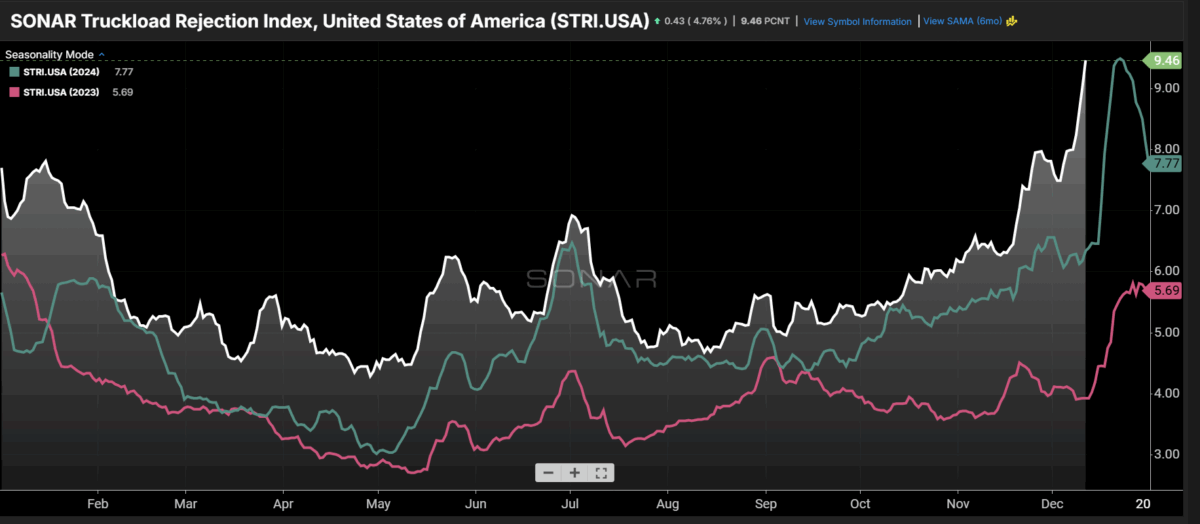

Chart of the week: SONAR Truckload Rejection Index – USA SONAR: STRI.USA

Released just a few weeks ago, the SONAR Truck Reload Index ( STRI ) has already surpassed last year’s Christmas peak reading of just under 9.5 percent. Values higher than about 7-8% generally indicate truck market inflation where there is not enough capacity. While that alone highlights last year’s drop in capacity, the absence of the typical post-Thanksgiving lull is just as notable. Declaring a definitive end to the prolonged shipping slump is difficult given the seasonality, but this is yet another sign that we are approaching a market tipping point — if there isn’t one already — driven largely by supply cuts.

Market swings are rarely detectable in real time. Hindsight provides the context and distance needed to determine whether a move is merely a blip or the beginning of a full transition. However, what this shipping market still lacks is a factor present in every previous contraction: strong demand.

While recent increases in rejection rates and liquidity are significant, a seasonal jump alone is not enough to confirm a market turnaround. Demand was relatively soft during the months leading up to the holiday shipping season.

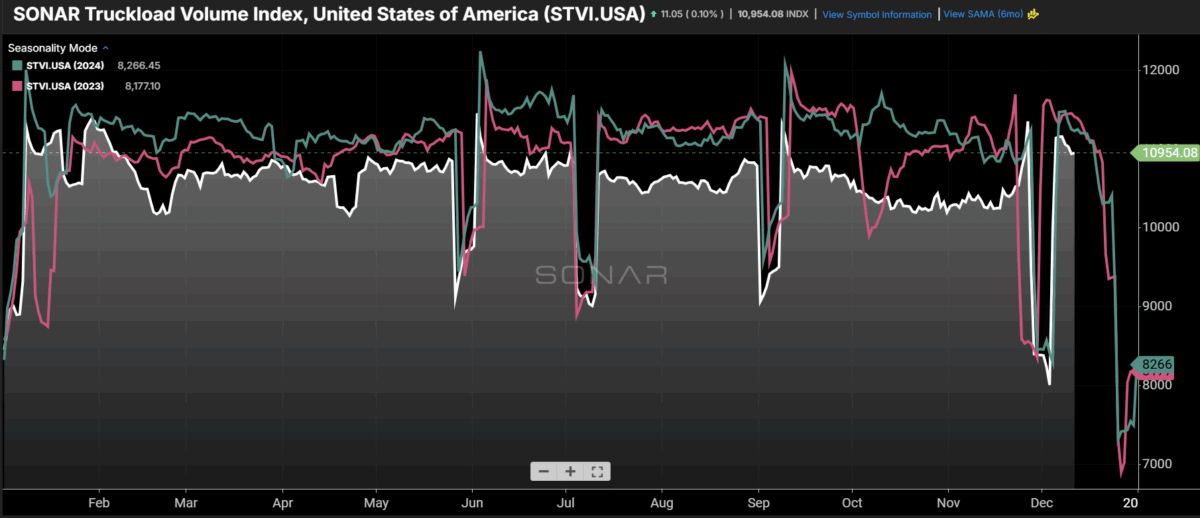

The SONAR Truckload Volume Index (STVI)—another enhanced version of the recently introduced Outbound Tender Volume Index (OTVI)—was down an average of 5 to 7 percent year-over-year through most of October and early November. The seasonal increase has outperformed the baseline, reducing the annual decline to about 2-3%, but the improvement has not been strong or sustained enough to signal a structural shift.

In the last week PhrytonomicsLogistics Manager Directory (LMI) co-author Dr. Zach Rogers noted that warehouse use was contracted for the first time in November.

LMI is measured on a 100-point scale, with values below 50 indicating contraction and values above 50 indicating expansion of the signal. It is natural for companies to use less warehouse space as seasonal inventory decreases, but the magnitude of this change is significant and the reasons for this are not entirely clear.

Monitoring inventory levels is critical for carriers because they provide insight into demand expectations and whether shippers are operating with lean, just-in-time inventory strategies or more buffered, fit-for-purpose approaches. The first type usually uses freight transport, as intermodal attractiveness is reduced due to longer transport times.

The stronger-than-expected seasonal decline may simply reflect higher inventory carrying costs, with shippers reducing inventories to limit the year-end tax burden. But the simultaneous increase in truck demand suggests that some companies may have been surprised by a stronger-than-expected holiday season.

Amazon’s Prime event set new records in October despite declining consumer confidence. Dr. Rogers noted that measures of trust have been increasingly affected by political sentiment over the past year, making them less reliable as indicators of spending behavior.

And while sentiment about the economy is low, the US is not in recession. The Federal Reserve cut interest rates last week and raised its GDP growth forecast for next year to 2.4 percent.

So there are reasons for cautious optimism about demand next year, with potential additional headwinds on the horizon, including tax cuts scheduled to take effect in 2026.

Even if demand doesn’t strengthen significantly, the bid rejection shows that the truck market has become — and will continue to become — increasingly vulnerable. Increased regulatory pressure will accelerate capacity shedding, although the main factor is insufficient rates and soft demand forcing operators out of the market.

About the weekly chart

The FreightWaves weekly chart is a selected chart from SONAR that provides an interesting data to describe the state of the freight markets. A chart is selected from thousands of potential charts in SONAR to help participants visualize the shipping market in real time. Every week a market expert posts a chart with commentary live on the front page. The weekly chart will then be archived on FreightWaves.com for future reference.

SONAR collects data from hundreds of sources, presents the data in charts and maps, and provides real-time explanations of what transportation market experts want to know about the industry.

Edit post

The post Christmas Comes Early for Freight Forwarding appeared first on FreightWaves.