You don’t wait until the house is on fire to learn how to use a fire extinguisher. The same applies to the burden claim. If you run a trucking business—whether it’s one truck or ten trucks—loading claims aren’t a matter of “if.” The issue is “when”.

When that day comes, your driver will either handle it like a pro or screw it up and cost your company time and money. The outcome depends on what you do right now – Not later.

What is the burden claim?

A cargo claim is a formal complaint filed by a shipper, broker, or consignee that the shipment did not arrive in the condition it was supposed to—damaged, missing, late, damaged, or otherwise inconsistent. It’s a paper trail that can lead to eating up the freight you thought you had already delivered.

The types of claims are:

- shortage – Part of the shipment is missing

- damage – The cargo is broken, dented, damaged or at risk

- delay – The cargo was not delivered in the agreed time window

- pollution – Especially in food or sensitive materials

- too much – You delivered more than what was in the invoice

Why are claims business killers?

A false claim can cause:

- load responsibility Payments (often up to $100,000)

- Termination of contracts With the sender or broker

- Legal disputes and rejected insurance claims

- Loss of access to certain lanes or load boards

Most importantly, you fame If you have a small fleet, your name is your brand. The market is tight. You can’t afford it.

What to teach your drivers – step by step

Here’s how to train your drivers no make the situation worse

Step 1: Inspect before leaving dock (if possible).

- If possible, ask your driver to inspect the load completely at the time of pickup.

- Are the pallets stacked correctly? Is the damage visible? Does the number match the BOL?

- Have them note any exceptions on the bill of lading immediately before signing.

- Consider a magnetic camera on a trailer that is Bluetooth connected to your smartphone.

Professional tip: If possible, train your drivers to take pictures before leaving the sender’s dock – especially if something looks suspicious. This could be your saving grace.

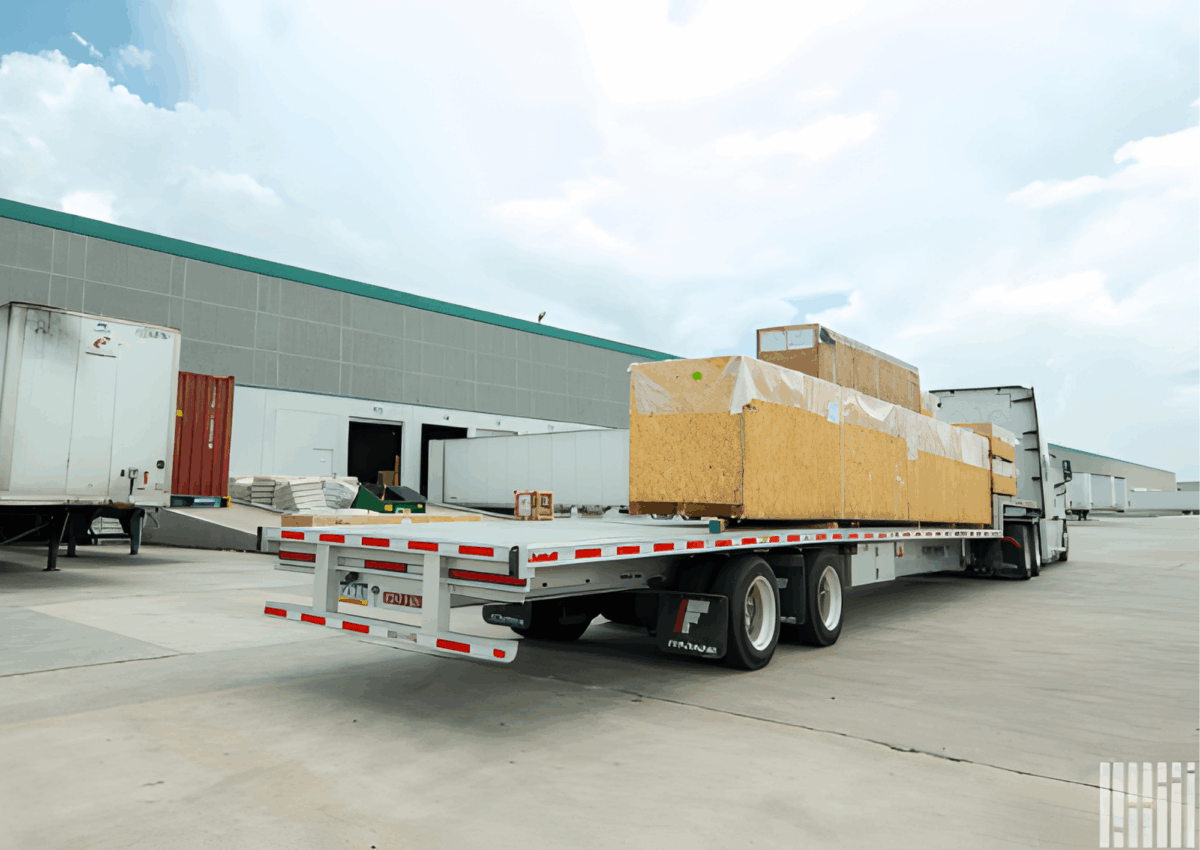

Step 2: Secure the load properly

Even if a sender loads a trailer, You are still in charge For how to ride it means:

- Security review

- Use a load bar, belt or blanket if needed

- Check temperature settings for referee units

If your driver senses a load shift in transit, that’s a red flag.

Step 3: Watch the clock

A late load is treated as a damaged load in rare cases.

- If traffic, breakdowns or weather delays your driver, they must notify dispatch and the agent as soon as possible.

- Always document the communication and make sure the recipient is aware.

Step 4: Monitor temperature loading religiously

For food grade ocean freight, small fluctuations can equal big claims.

- Drivers should record temperatures during pick-up and drop-off (both reefer and pulp temperature). Some monitoring systems provide instantaneous temperature readings

- Make sure they are trained on how to read dough thermometers and enter judging codes.

Step 5: Deliver the document like a pro

- Make sure the BOL is signed and stamped – no exceptions unless noted

- If the consignee rejects part or all of the shipment, document why

- Take clear photos of any damaged products

These documents can be the difference between paying out of pocket and having insurance that covers the load.

How to prevent bar claims before they happen

Responsive training is excellent. Education is better for prevention. This may seem small, but it’s the culture you build that matters the most.

1. Create a driver manual

Have a clear SOP for each type of cargo you carry. If you’re handling food, you need different protocols than when you’re using electronics.

It is based on:

- Loading procedures

- Security rules

- Temperature management

- POD collection steps

- Photo documentation expectations

Make it readable and real—not a 100-page binder gathering dust.

2. Maintain pre-trip and post-trip accountability

Use digital forms (such as Whip Around or Motive inspections) to:

- Trailer conditions before travel

- The door seal is intact and included

- Reefer fuel and pre-cooling stages

- BOL confirmation matches cargo content

Post-trip reports should be mandatory, even if nothing goes wrong.

3. Enter the claims response in the direction of your driver

Most fleets train ELD registration and safety, but leave claims handling to chance.

Include a “what to do in case of a claim” training module for each new hire:

- Scripts to talk to brokers or shippers

- Emergency contact chain

- Insurance claim documentation process

what to do after A claim occurs

1. Get the facts – not the emotions

Train your drivers to report only what they know. No guessing no blame

Request:

- Photo of sender and receiver

- Pictures of the ELD and HOS route

- Reference data download reports (if any)

- Witness name and phone number (if present at the location)

2. Ring in insurance and/or legal quickly

Freight claims must be submitted to your insurance company within 24 hours.

But don’t rely on the insurer to fight you. Create a clean documentation path:

- Driver’s statement

- Photos

- BOL copies with notes

- Records of communication with the shipper/broker

3. Determine the payment liability

- If it is a broker’s burden: The broker may deduct the claim from the future load payment.

- If the shipping is direct from the sender: You may lose your account completely or face legal action.

This is where the language of your cargo insurance policy matters. Find out if your policy includes:

- Franchises

- Exceptions (eg, spoilage due to mechanical failure)

- Claim reporting time windows

Frequently Asked Questions (FAQ)

Q: Can a carrier deny a claim if it did not cause the damage?

Answer: Yes – but only if there is clear documentation that it was either the sender’s or the receiver’s fault. This is why photos, BOL exceptions and temperature reports are so important.

Q: Will my insurance cover any damage?

Answer: Not always. Many policies have exclusions – particularly for breakdown, negligence or mechanical breakdown. Read your fine print

Q: How long should I apply for the insurance policy?

A: It varies, but some insurers require notification within 24-48 hours of delivery. Waiting too long can destroy coverage.

Q: What if my driver didn’t report the problem until after they left?

Answer: This is a big risk. Late reporting often voids coverage and prevents you from contesting the claim. Train your drivers to report before leaving the dock.

final thought

Load claims don’t just cost you – they show how strong (or weak) your performance really is. You’ll find out if your driver is trained, if your SOPs are consistent, and if your paperwork can handle the heat.

The best defense is preparation. Train your drivers so that one mistake is one mistake away from a $10,000 claim every time. Because sometimes, it is.

That’s the game we’re in. And if you want to stay in it – if you want Scale In that – then treat claims prevention and handling as seriously as you treat revenue.