This sound is produced automatically. Please let us know if you have feedback.

Editor’s note: This story is part of a series that is displayed from a July 23 event hosted by Dive Dive, Trucking Dive, Diving and Diving Packaging. Register here to watch again on request.

Mares prioritizes imminent costs on China -related ships.

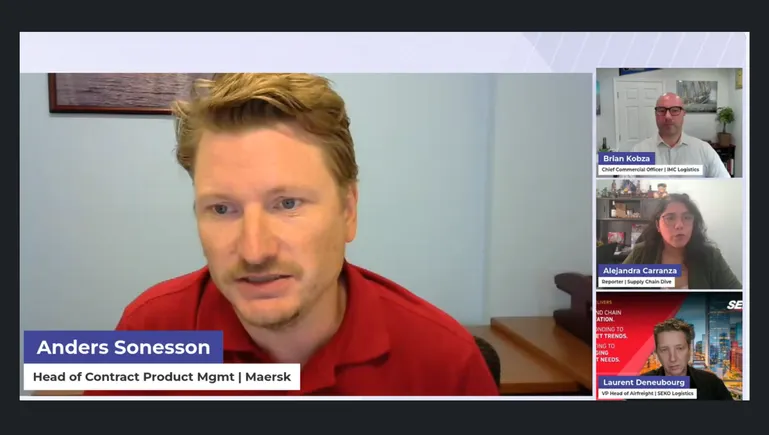

Sonesson, who serves as the head of the North American contract management product management at AP Moller – Maersk, also noted that the ocean transport company could easily deploy China -made ships in other Tradlanes because of its global network, which remains unchanged.

“We also do not want to put Chinese -made ships in US trade if it costs millions of dollars to contact us,” Sonson said. “So, I think that’s what I expect to see from the rest of our rivals and the alliances.”

In April, the US trade representative office introduced a free structure to target China -related ships. Since October 14, China -related ships calling in US ports are at a cost of between $ 18 per ton nets of up to $ 120 per container. These rates rise in each month of April.

These costs are intended to enhance domestic shipbuilding, according to USTR. However, some stakeholders doubt this effect and say that this will increase the cost of transportation and consumer price without strengthening the US role in the ocean.

According to Sanson, Maires does not intend to pay any additional costs or costs related to this offer, because it is not realistic to pay shipping to pay costs that no control over them.

“It will be very difficult for us to justify why you have to pay because you load it on a Chinese -made ship because it is not really to customers to choose what ships they are loading,” he said.

Brian Kubda, the senior manager of IMC, said the proposal would probably lead ships to integrate ports and lead to congestion.

“Whenever you see more volume [a] Single port, that type of congestion has a lot of low -hand effects. [distribution centers]”Whenever you create that type of crowd, you just add costs and reduce reliability in the supply chain,” Kubza said.