The container transportation sector is entering a period of structural regulation because the capacity of the extra ship, the reduction of cargo rates and the change of world trade routes of the commercial dynamic transformation.

According to Wishwaine Marine Vision of the transport market for Q3 2025With Adaptation Vat Cost efficiency Will be important to move in the coming months.

The global transport market continues to be defined by Geopolitical stressesWith Business disruption Vat Macroeconomic uncertaintyHumans Outlook Veson Nautical’s Q3 2025 Outlook shows how these pressures are heavily distributed in the container sector, which faces rising challenges after a rapid expansion of the fleet.

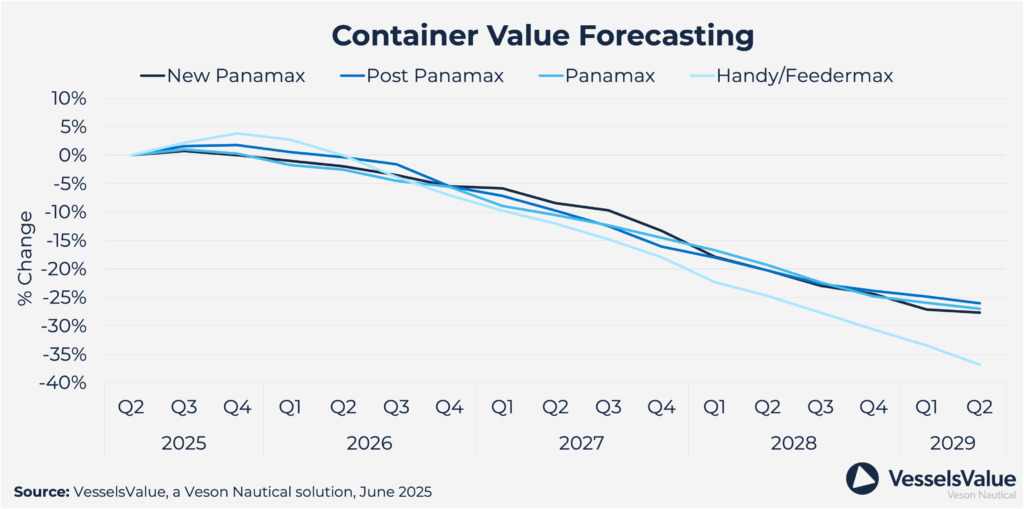

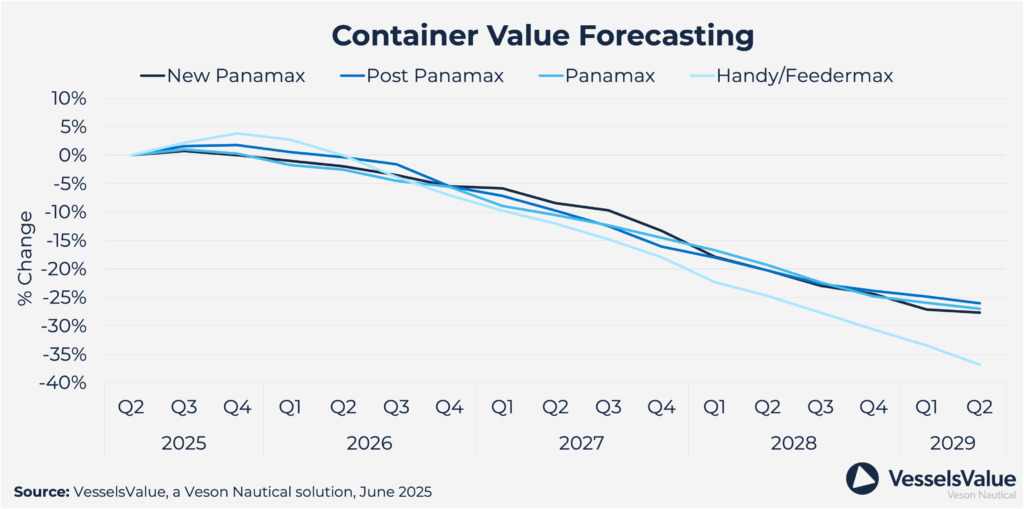

The net container fleet expanded in 2023 with 5.5 % and 9.7 % in 2024, with an average annual growth of 8.2 percent from 2025 to 2028. 2024Which almost see 4.3 million Teu has been added to the order bookAs a result, the ratio of the book to field has reached 31.1 %, a level that has not been seen in recent years.

Read: Veson Sea, Eastern Big Transport Unveils IMOS OS

A significant trend of change in order of preferences, with growth Get away from New-Panamax Ship In favor of the ultra -large container ships (ULCVS)Humanity reflects the evolution of world trade patterns and the constant emphasis on scale economics.

Despite this growth, New orders have fallen sharply in the year 2025As an increase in shipbuilding costs and a saturated order of new activity. Veson points out that this is likely to reduce the pressure on shipbuilding capacity in the medium term.

On the scratch front, the activity is conquered, but it is expected to increase, especially among smaller ships below 3000 TEU. These older vessels are less usable because the high operating costs remain and the transportation rates are still reduced.

Read: Order Book Trends point to the tighter offering in the CapeSize market

Beyond containers, nautical notes Veson continuous fluctuations in Tanker marketsCaused by the tensions of the Red Sea and the EU’s sanctions on Russian oil that has re -conducted trade Reinforced the tone demandMankind. However, tanker Fleet Expected Demand beyond 2025 Due to new delivery and low waste, with regulatory pressures and changing oil consumption patterns that cause prolonged uncertainty.

As well, Much of The benefits of rEducated order books Vat Emerging business pathsLike the increase in iron ore cargoes from Guinea, it supports the growth of the miles despite the softer demand related to China’s economic challenges. Geopolitical risks continue to affect the restore ship and transportation rate, even if the general order activity between the sectors is slow among the new construction costs.

Crossing the mid -2025 point, it finds its maritime trade in the turbulent waters, not from storms or tides, but from geopolitics.

Read our unique analysis of our unique analysis for a deep exploration on how to transform this industry dynamics: Geopolitics at sea: Storm scroll in 2025